One Of The Best Info About How To Keep Good Business Records

According to the internal revenue tax code, you must keep your records as long as they may be needed for the administration of any part of the tax code.

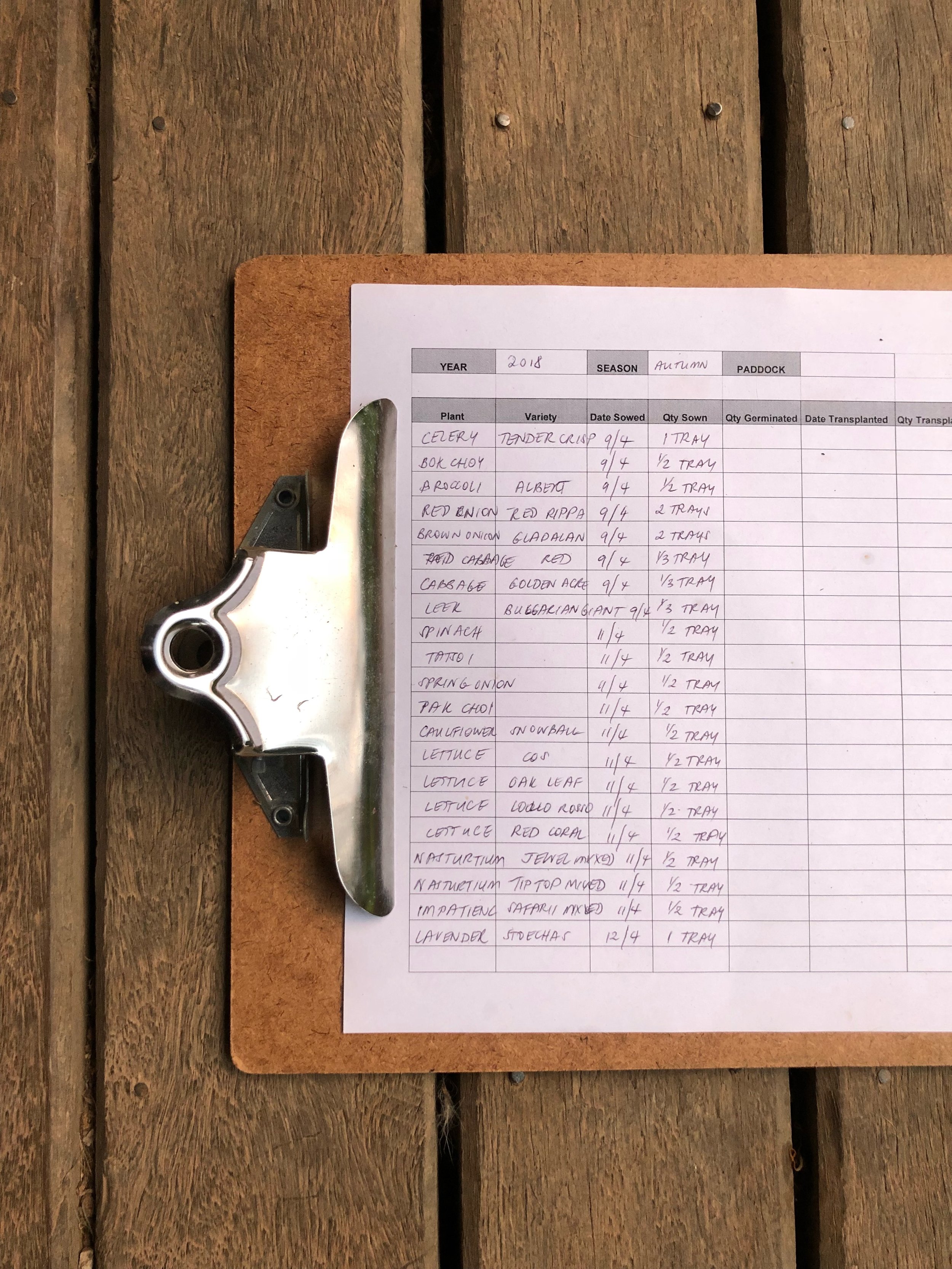

How to keep good business records. Why should i keep records? Assess the type of business you have. If monthly statements aren’t necessary for tax or any other business purposes, you can get rid of them after a year and just keep detailed annual statements for at least 3 years.

Good records will help you do the following: Keeping good records is good business. Save copies of your tax returns and any supporting documents.

[1] corporations will have different. The type of business records you need to keep is directly related to the type of business you have. Business records you need to keep 1.

Over 80% of customers agree that quickbooks helped them find additional tax savings. Hmrc requires business owners and sole traders to keep good business records so the correct amount of tax can be calculated and paid. The irs goes into further details for the types of records you should keep.

Over 80% of customers agree that quickbooks helped them find additional tax savings. For both small and large businesses, a good recordkeeping system should include a summary of your business transactions. Keep records for six years if you do not report income that you should report and it is more than 25% of the gross income shown on your return.

Ad save time with automatic, personalized sales tax calculations on your invoices. Keep records indefinitely if you do. Monitor the progress of your business.

Maintaining good records for your business not only helps to meet your tax and legal obligations, but it can save you money. You may need them for audits, legal disputes, lease applications,. Probably the most obvious reason for keeping good business records is that it keeps you on the right side of the law.

On this gov.uk page, hmrc makes it clear that. Keeping good records is very important to your business. The ato recommends that businesses use electronic record keeping if possible, as they are progressively moving towards.

Ad save time with automatic, personalized sales tax calculations on your invoices. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income,. This documents the income your business received.