Best Tips About How To Buy First Home

Close on your new home.

How to buy first home. Determine your budget for a house before looking. Examine your credit history and improve your credit score where needed. Negotiate any repairs or credits with the seller.

Buying the home as part of a household where total income is no more than £80,000 (or £90,000 if you live in. Your real estate agent can help you find a home that meets your wants and needs. Able to get a mortgage for at least half the price of the home;

Buying your first home is an exciting time, but it also can be an overwhelming process, especially in today’s crazy housing market. It is really important you have the right information, at the right time, to ensure you make informed. Buying a home is often the largest purchase you will make in your lifetime.

Start saving early here are the main costs to consider when saving for a home: Tips for buying your first home: D) after the discount has been applied, the first sale must be at a price no higher than £250,000 (or £420,000 in greater london).

This is because it’s hard to save for a deposit and pay. Decide how much home you can. The first steps to buying a house are to prep your finances and determine your budget.

Buying your first home is all about saving for a deposit and this is often the biggest barrier to buying a first home. First homes are the government’s preferred. It is crucial to proactively plan for this big.

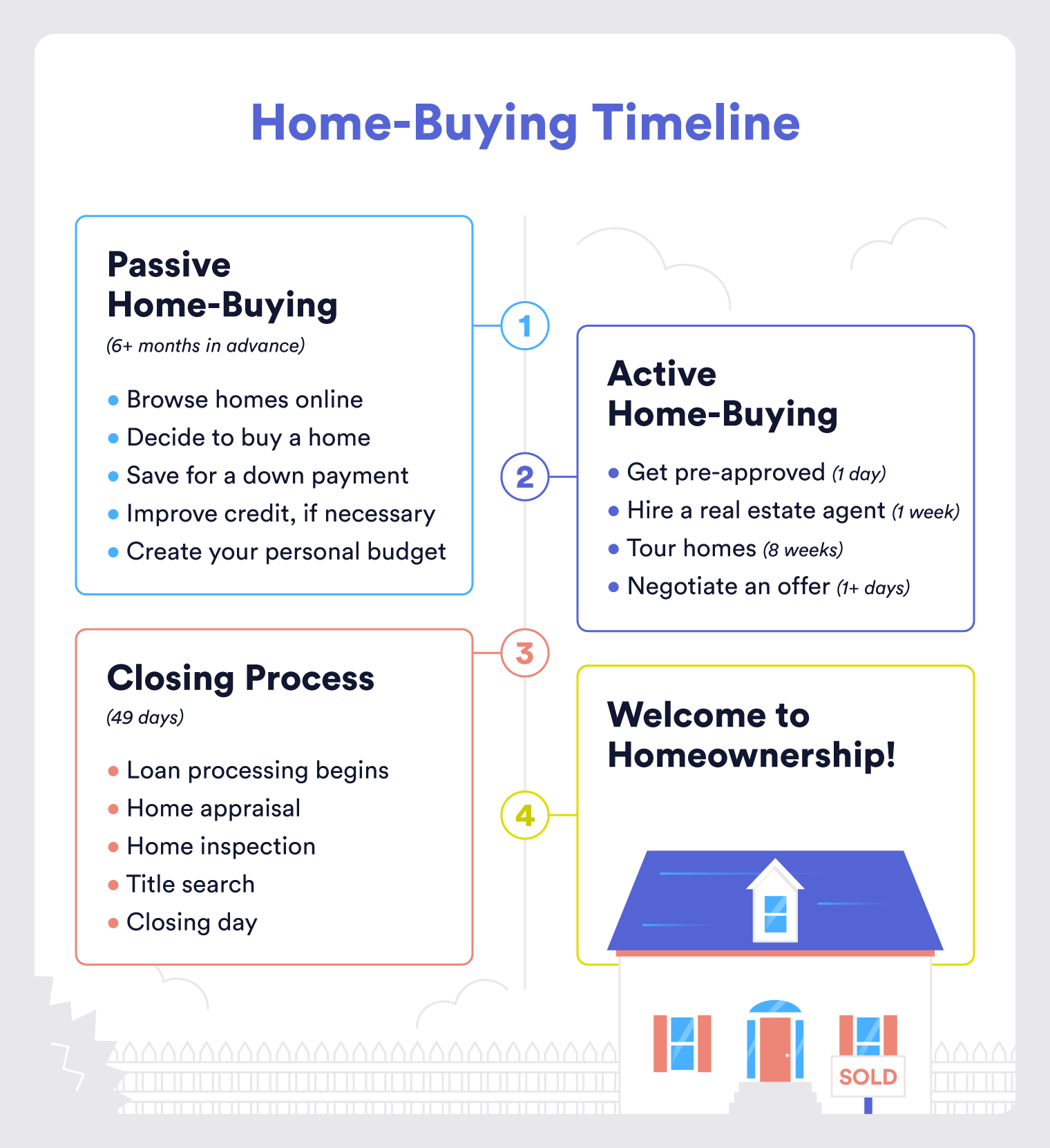

We’ve broken down the homebuying process into.