Neat Info About How To Apply For The Housing Tax Credit

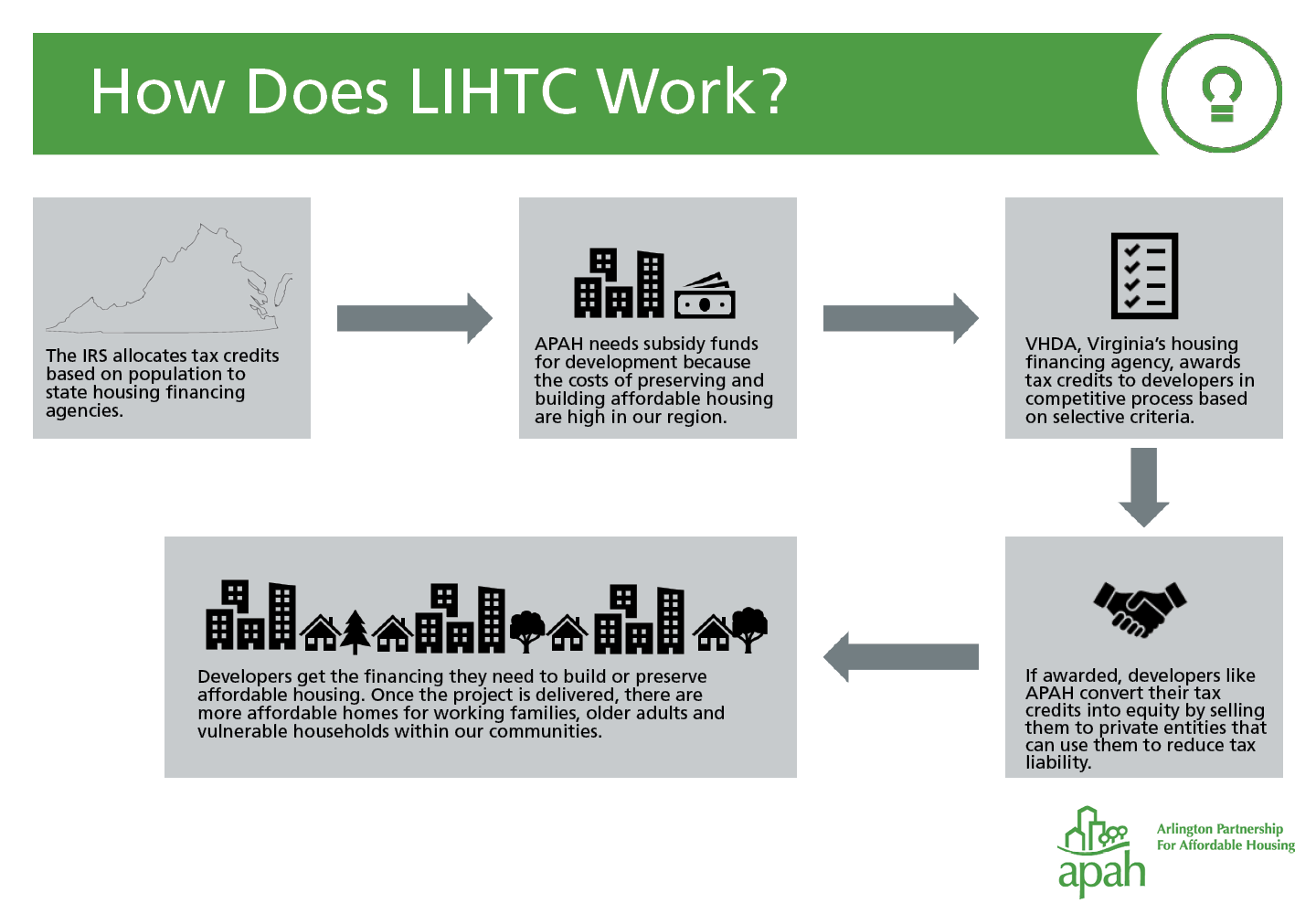

Created by the tax reform act of 1986, the.

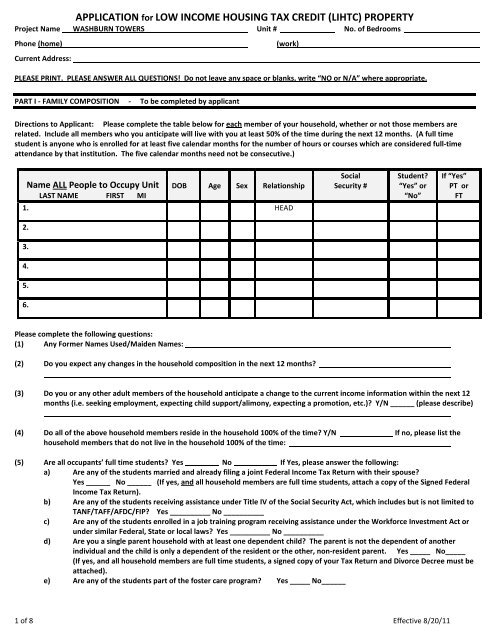

How to apply for the housing tax credit. Applicants must complete and submit the one stop housing. The oahtc allows banks to reduce interest rates on loans for affordable housing by 4% and claim a state income tax credit equal to the lost interest income caused by the lower rate. The application must be obtained per the housing office’s instructions.

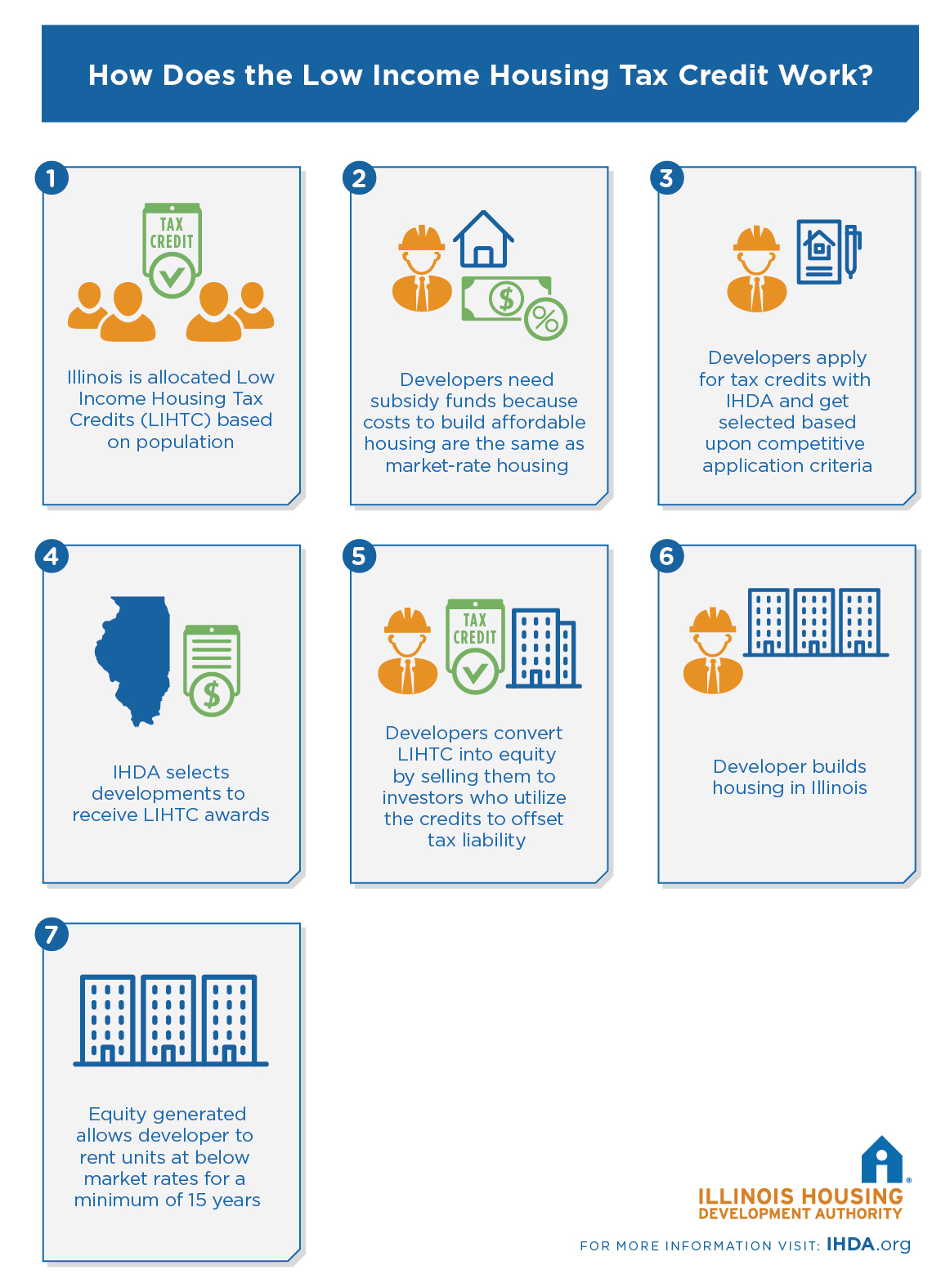

Ad sell your home with simplicity, speed and certainty. However, if the bond issuer is the hfa, typically the hfa accepts one unified. The 9% htcs are allocated twice per year through a competitive process:

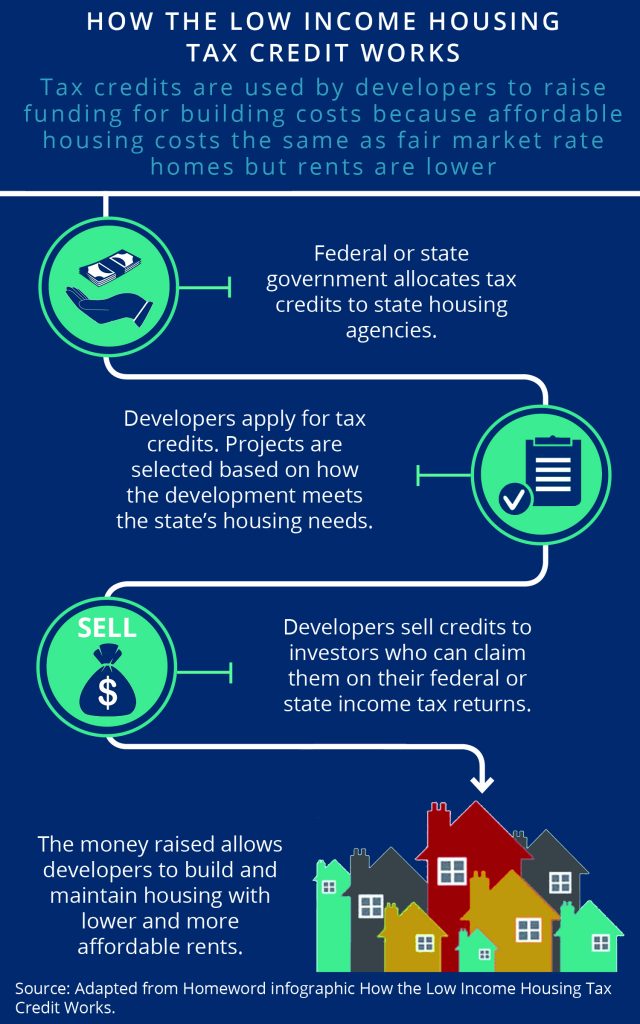

These applications must meet the. The purpose of this program is to help reduce the. Housing credits provide a federal income tax credit as an incentive to investors.

Dhcd makes low income housing tax credit funding available through a notice of funding availability (nofa), twice yearly. Prime minister justin trudeau has announced a number of new programs, including the launch of a new dental care program, doubling the gst tax credit temporarily, and. Federal law mandates developments to separately apply to the housing finance agency (hfa) for the 4% credits.

Applications are usually available online, by mail, or in the housing authority's office. Being awarded (or denied) a reservation of the credits it. Submitting an application to the state’s competitive allocation process in conformance with the state’s qap;

To apply for the credit, the first important thing to note is the deadline is coming fast—september 15 but the application can be done online, so there’s still time. The tax credit encourages developers to build affordable housing to meet the needs of the community. Qualified home purchasers should apply in advance for the homeowners' tax credit before acquiring title to the property.

To apply, contact or visit the management office of each apartment building that interests you. Apply for housing tax credits.

![Infographic] The Low Income Housing Tax Credit Program: How Does It Work? | Wilson Center](https://www.wilsoncenter.org/sites/default/files/styles/embed_text_block/public/media/images/article/lihtc-mechanism-chart.png)