Looking Good Tips About How To Improve A Low Credit Score

It may feel impossible to escape from bad credit history though, so we at the home.

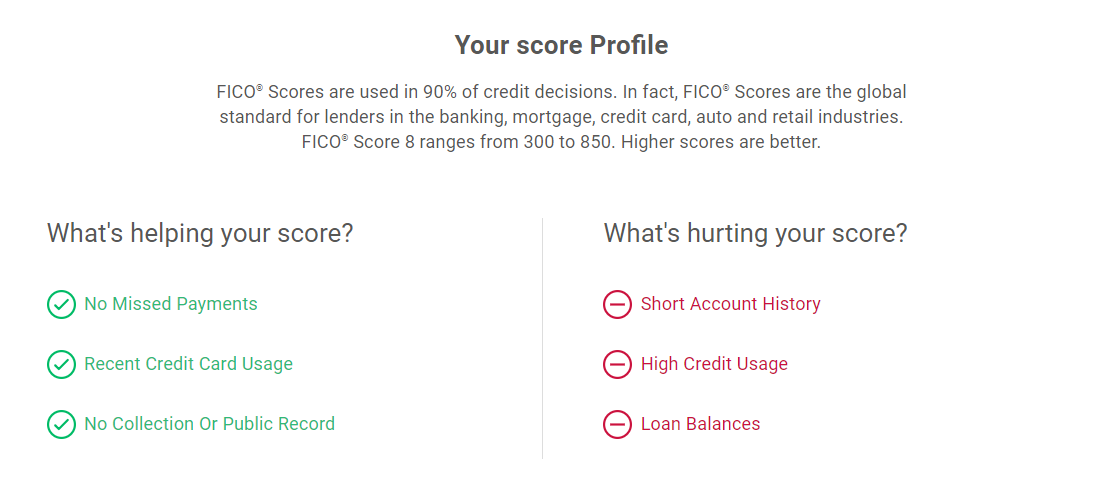

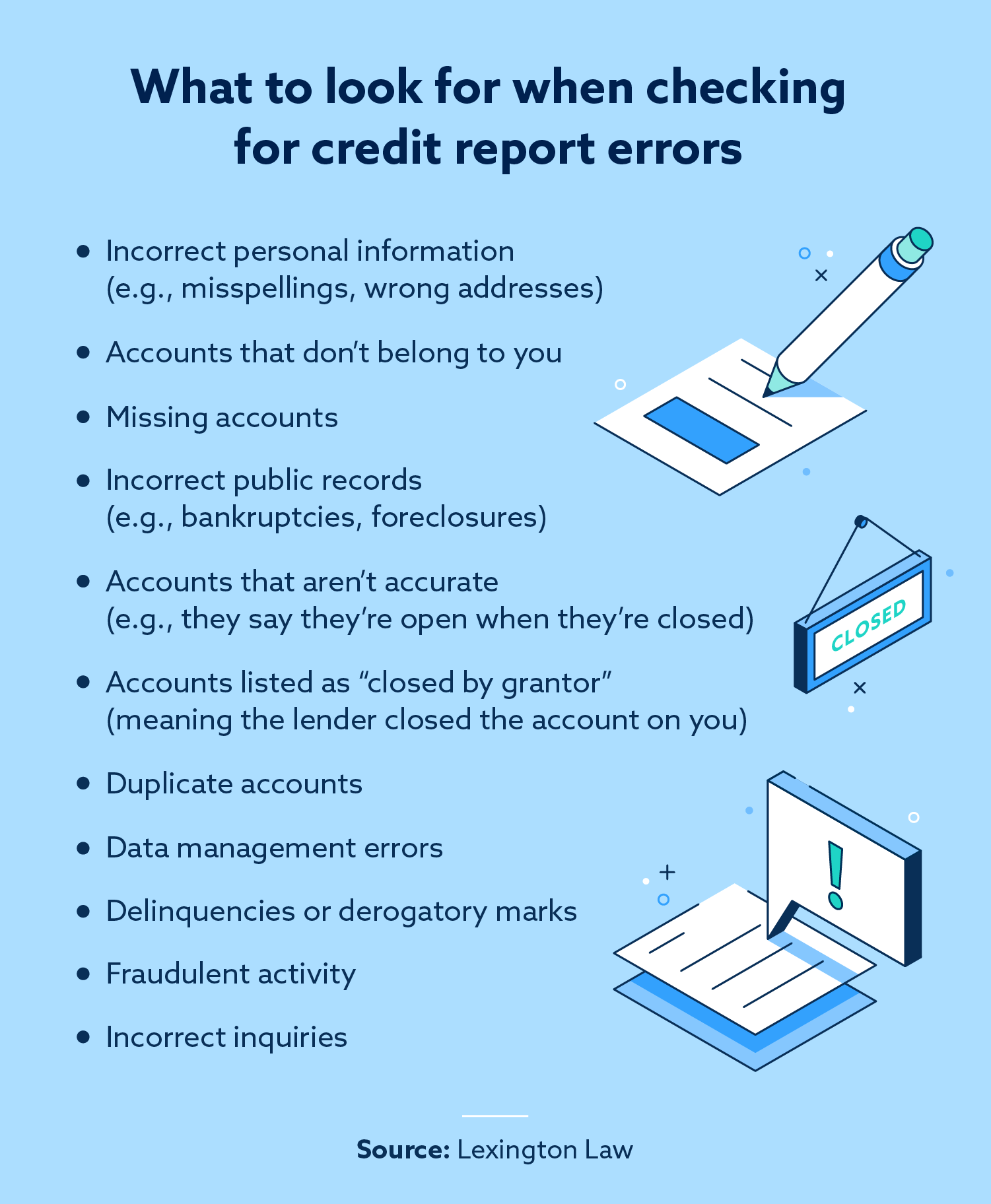

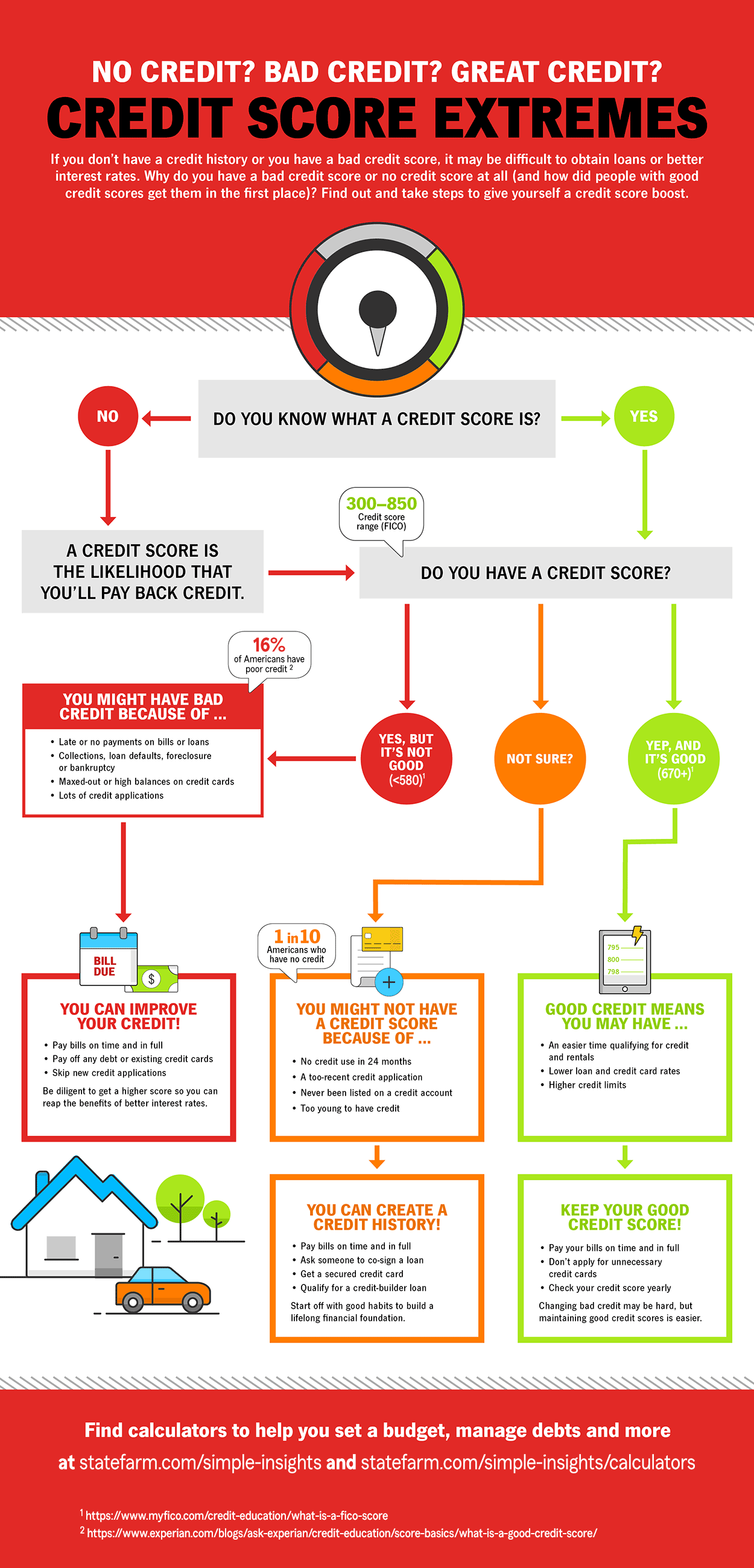

How to improve a low credit score. Therefore, the next important step to take to improve your credit score would be to keep your credit utilization as low as possible. In such cases, banks may refuse to give you a loan. Check your credit report for errors.

You can increase your fico® score for free. I lowered my credit utilization ratio by 19%! One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you.

Find out where you stand. Whether it’s student loans, credit cards, mortgages, or a combination, you want to make sure. Missed payments, defaults and court judgments will stay on your credit report for six years.

The total amount of money one owes will show how deep into debt they are and will affect their credit score. A low credit score indicates that you may have failed to pay credit card bills on time or have delayed paying emis. Maintaining a good credit score can get you access to loans and new lines of credit at favorable rates.

Here are five tips that could help you increase your chances of a credit card approval. Stay focused to improve your credit. Get ready for the shocker:

Paying your accounts regularly and on time will improve your score as you build a credit history. “a boost from fair credit to very good could lead to $40,041 in mortgage. The major contributing factor to improving my credit score in just 30 days was decreasing my credit utilization ratio.

This type of loan, backed by the federal housing administration (fha), can help buyers with lower credit scores get into a home. 1 hour agothe study also noted that boosting your credit score has the largest impact on home mortgage costs. Ad learn what's wrong with your credit with a free personalized consultation today!

But good credit opens a world of opportunities, making it. A history of prompt payment will improve a low credit score. When you apply for new financing—credit cards or otherwise—the lender is.

Generally, when you open a new credit account, it will lower your credit score slightly, at least for a short period. Ad 2021's best credit repair companies. This range includes the average fico score in the u.s.

It takes time to improve your credit, and can be challenging on a low income. The fastest ways to increase your credit score include paying bills on time, becoming an authorized user, increasing credit limits without increasing your balances, and. Ad increase your fico® score & get credit for the bills you're already paying.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)