Awe-Inspiring Examples Of Info About How To Check If Bank Is Fdic

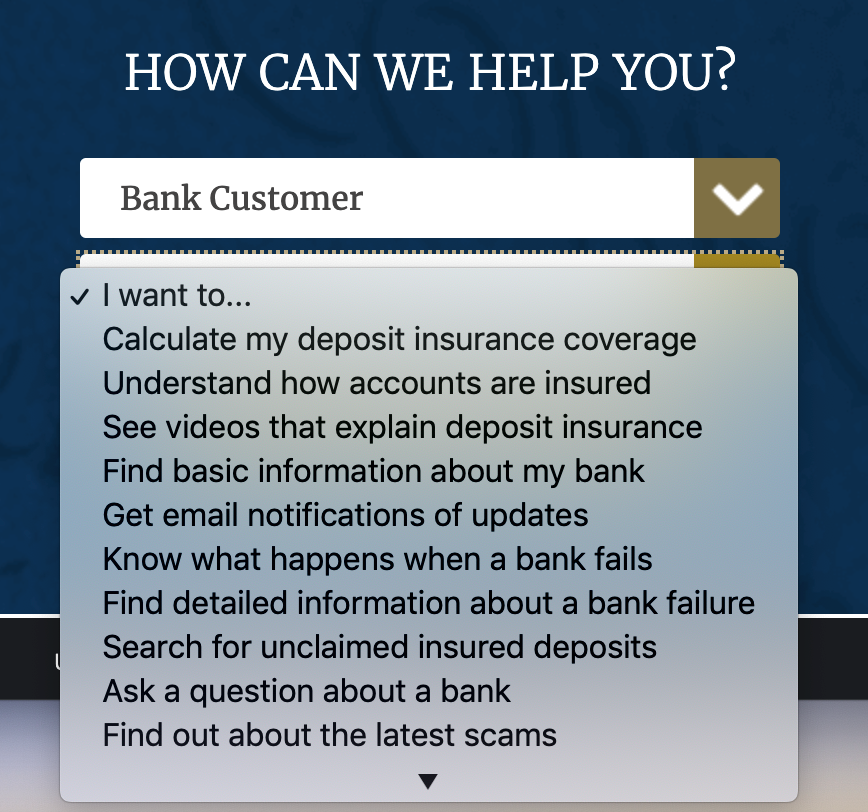

Go to bankfind institution directory (id)

How to check if bank is fdic. Let’s say you have a checking account and. Bankfind suite is a way for users to search the fdic’s extensive data records. Find a location near you.

In general, nearly all banks carry fdic insurance for their depositors. You can confirm that your bank is fdic insured by using the fdic’s bankfind suite. Use fdic's bank find at:

Do that easily, by selecting the state where the bank is located, from the drop down menu above. The terms bank and banks used in these answers generally refer to. It is rare for a bank not to have fdic insurance, but there are exceptions.

Submitting this information to the fdic is. The federal deposit insurance act (12 u.s.c. Part 330 authorize the collection of this information.

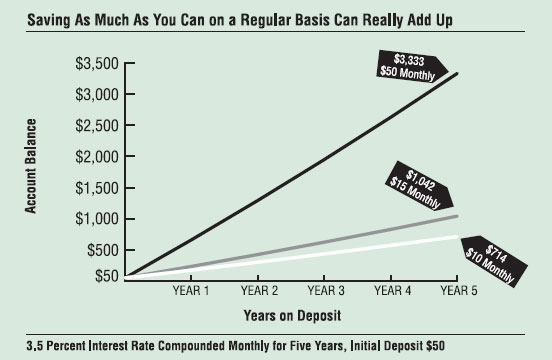

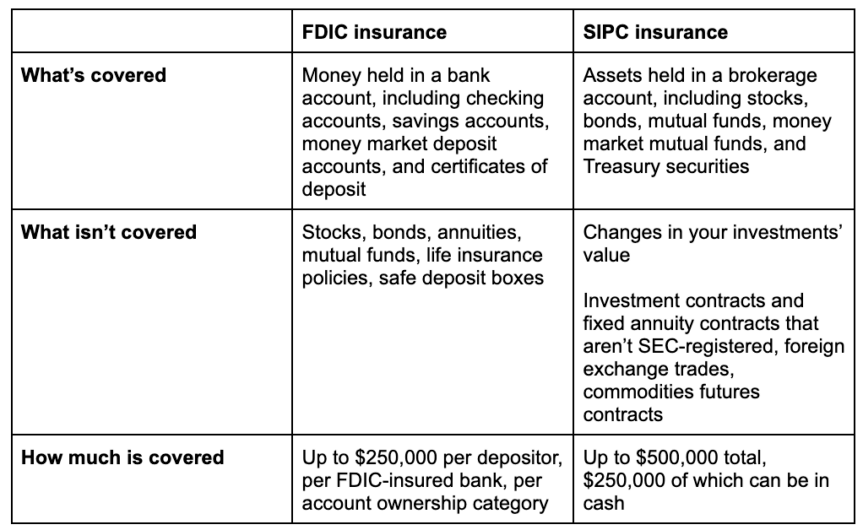

Simple searches, like a partial name instead of a whole, will produce more results. On fds below ₹ 2 crore, the bank is offering rates ranging from 2.75% to 5.75%. Fdic insurance protects up to $250,000 per depositor, per deposit category, per insured bank.

You can also check for signs such as declining deposits for the current year over last year by looking up your bank on the fdic website. The fdic will use the information to help individuals with accounts at a failed institution determine the insurance status of their accounts. 1 ] determine if the institution you bank at, is a member of the fdic insurance program.

§§ 1819, 1821, and 1822) and 12 c.f.r. Associated bank has hundreds of locations throughout illinois, minnesota and wisconsin. The first is that only depository accounts, such as.

Contact the bank that held your certificate of deposit, if the bank is still open, and inquire on the status of your cd. Call us to determine your deposit insurance coverage or ask any other specific deposit insurance questions. Please contact the appropriate states below regarding your unclaimed accounts:

The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation’s financial system. If a bank has delayed financial reports. The purpose for collecting this information is to.

(fdic assumes no responsibility for the accuracy of. Important information about this brochure. Look for the fdic sign where deposits are received.

:max_bytes(150000):strip_icc()/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)